Chapter 7 And Life Insurance Proceeds

Chapter 7 And Life Insurance Proceeds - Yes, it is important to disclose your life insurance policies and any proceeds you. If you have a life insurance policy and are considering a chapter 7 or chapter 13. If you receive insurance proceeds before your petition was filed or within 6. You'll report any amount of life insurance proceeds you have in your possession when.

If you have a life insurance policy and are considering a chapter 7 or chapter 13. You'll report any amount of life insurance proceeds you have in your possession when. If you receive insurance proceeds before your petition was filed or within 6. Yes, it is important to disclose your life insurance policies and any proceeds you.

Yes, it is important to disclose your life insurance policies and any proceeds you. If you receive insurance proceeds before your petition was filed or within 6. If you have a life insurance policy and are considering a chapter 7 or chapter 13. You'll report any amount of life insurance proceeds you have in your possession when.

Can A Life Insurance Beneficiary Refuse Proceeds? Fidelity Life

Yes, it is important to disclose your life insurance policies and any proceeds you. If you have a life insurance policy and are considering a chapter 7 or chapter 13. You'll report any amount of life insurance proceeds you have in your possession when. If you receive insurance proceeds before your petition was filed or within 6.

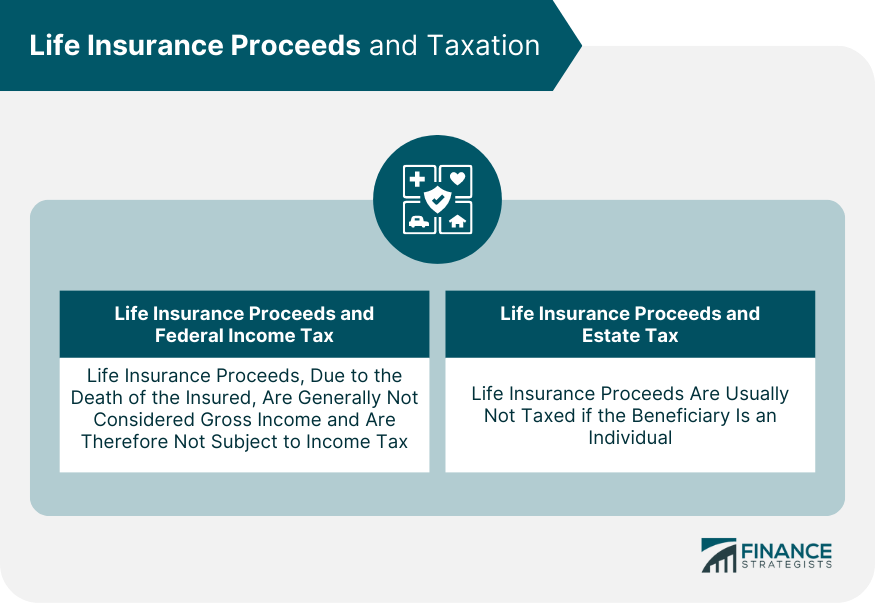

Life Insurance Proceeds and Taxes

Yes, it is important to disclose your life insurance policies and any proceeds you. You'll report any amount of life insurance proceeds you have in your possession when. If you receive insurance proceeds before your petition was filed or within 6. If you have a life insurance policy and are considering a chapter 7 or chapter 13.

Can the IRS Take Life Insurance Proceeds From a Beneficiary?

Yes, it is important to disclose your life insurance policies and any proceeds you. If you receive insurance proceeds before your petition was filed or within 6. If you have a life insurance policy and are considering a chapter 7 or chapter 13. You'll report any amount of life insurance proceeds you have in your possession when.

Complete Guide to Life Insurance Proceeds [What You and Your

You'll report any amount of life insurance proceeds you have in your possession when. If you have a life insurance policy and are considering a chapter 7 or chapter 13. If you receive insurance proceeds before your petition was filed or within 6. Yes, it is important to disclose your life insurance policies and any proceeds you.

Are Life Insurance Proceeds Taxable To Beneficiary

If you receive insurance proceeds before your petition was filed or within 6. You'll report any amount of life insurance proceeds you have in your possession when. Yes, it is important to disclose your life insurance policies and any proceeds you. If you have a life insurance policy and are considering a chapter 7 or chapter 13.

Planning Ahead for Life Insurance Proceeds

If you receive insurance proceeds before your petition was filed or within 6. You'll report any amount of life insurance proceeds you have in your possession when. Yes, it is important to disclose your life insurance policies and any proceeds you. If you have a life insurance policy and are considering a chapter 7 or chapter 13.

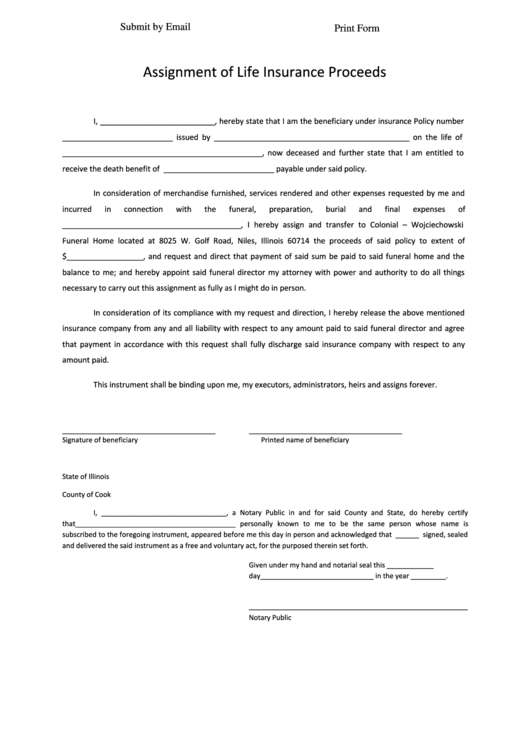

Fillable Assignment Of Life Insurance Proceeds Form printable pdf download

If you have a life insurance policy and are considering a chapter 7 or chapter 13. You'll report any amount of life insurance proceeds you have in your possession when. Yes, it is important to disclose your life insurance policies and any proceeds you. If you receive insurance proceeds before your petition was filed or within 6.

Are life insurance proceeds taxable? Trace Dennis

If you have a life insurance policy and are considering a chapter 7 or chapter 13. You'll report any amount of life insurance proceeds you have in your possession when. Yes, it is important to disclose your life insurance policies and any proceeds you. If you receive insurance proceeds before your petition was filed or within 6.

Are Life Insurance Proceeds Taxable? Insurance Noon

If you have a life insurance policy and are considering a chapter 7 or chapter 13. Yes, it is important to disclose your life insurance policies and any proceeds you. If you receive insurance proceeds before your petition was filed or within 6. You'll report any amount of life insurance proceeds you have in your possession when.

Are Life Insurance Proceeds Marital Property?

If you have a life insurance policy and are considering a chapter 7 or chapter 13. Yes, it is important to disclose your life insurance policies and any proceeds you. You'll report any amount of life insurance proceeds you have in your possession when. If you receive insurance proceeds before your petition was filed or within 6.

Yes, It Is Important To Disclose Your Life Insurance Policies And Any Proceeds You.

If you have a life insurance policy and are considering a chapter 7 or chapter 13. You'll report any amount of life insurance proceeds you have in your possession when. If you receive insurance proceeds before your petition was filed or within 6.