Florida Sales And Use Tax Form

Florida Sales And Use Tax Form - You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay sales tax and discretionary sales surtax online at floridarevenue.com/taxes/registration (you. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes.

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay sales tax and discretionary sales surtax online at floridarevenue.com/taxes/registration (you. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes.

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay sales tax and discretionary sales surtax online at floridarevenue.com/taxes/registration (you. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes.

Florida Sales And Use Tax Form Dr 15ez Tax Walls

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay.

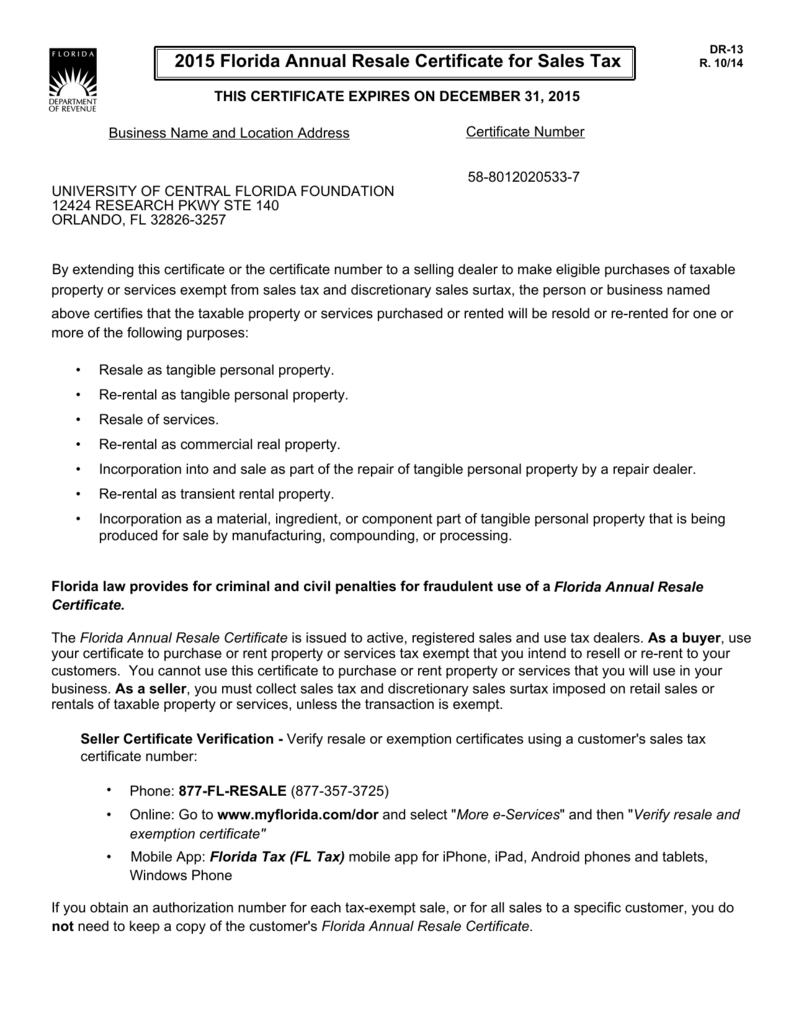

2015 Florida Annual Resale Certificate for Sales Tax

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay sales tax and discretionary sales surtax online at floridarevenue.com/taxes/registration (you. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales.

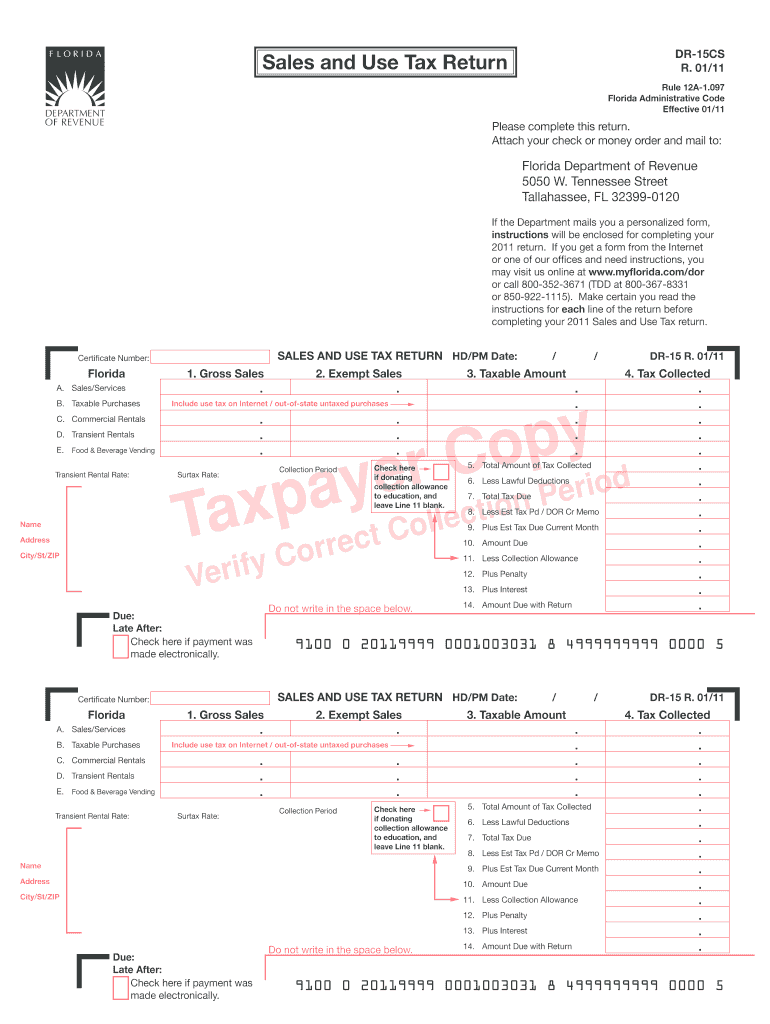

20112024 Form FL DoR DR15CS Fill Online, Printable, Fillable, Blank

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay sales tax and discretionary sales surtax online at floridarevenue.com/taxes/registration (you. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales.

Florida Sales Tax Exemption Application Form

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay.

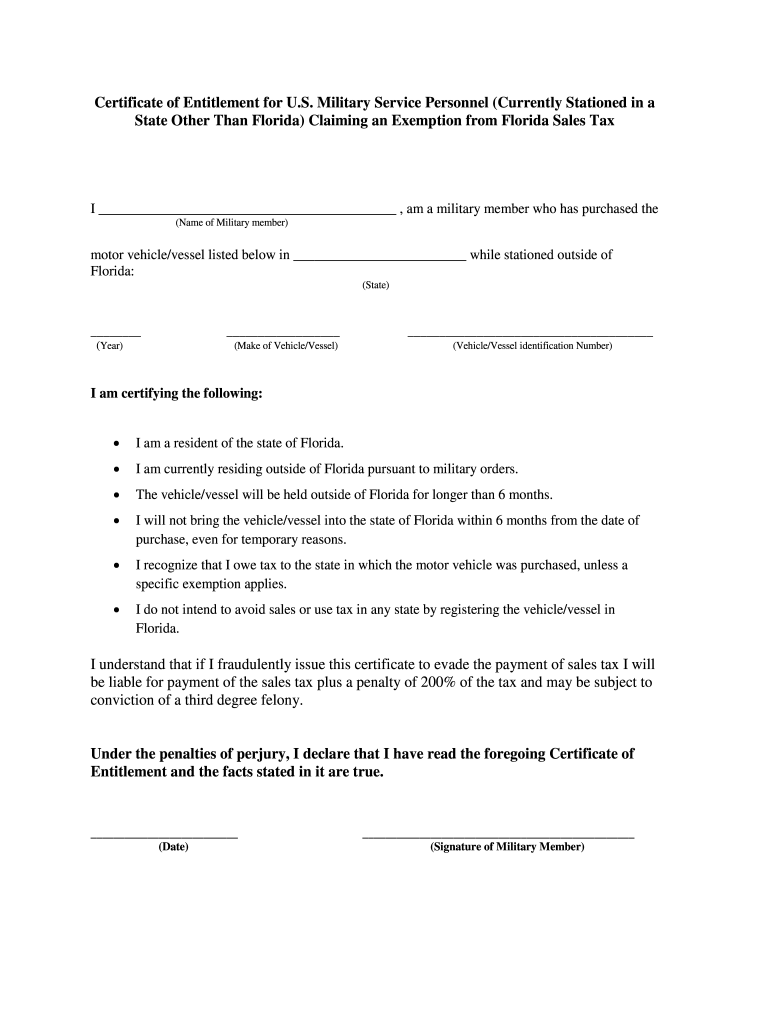

Florida Military Exemption Tax Fill Online, Printable, Fillable

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay sales tax and discretionary sales surtax online at floridarevenue.com/taxes/registration (you. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales.

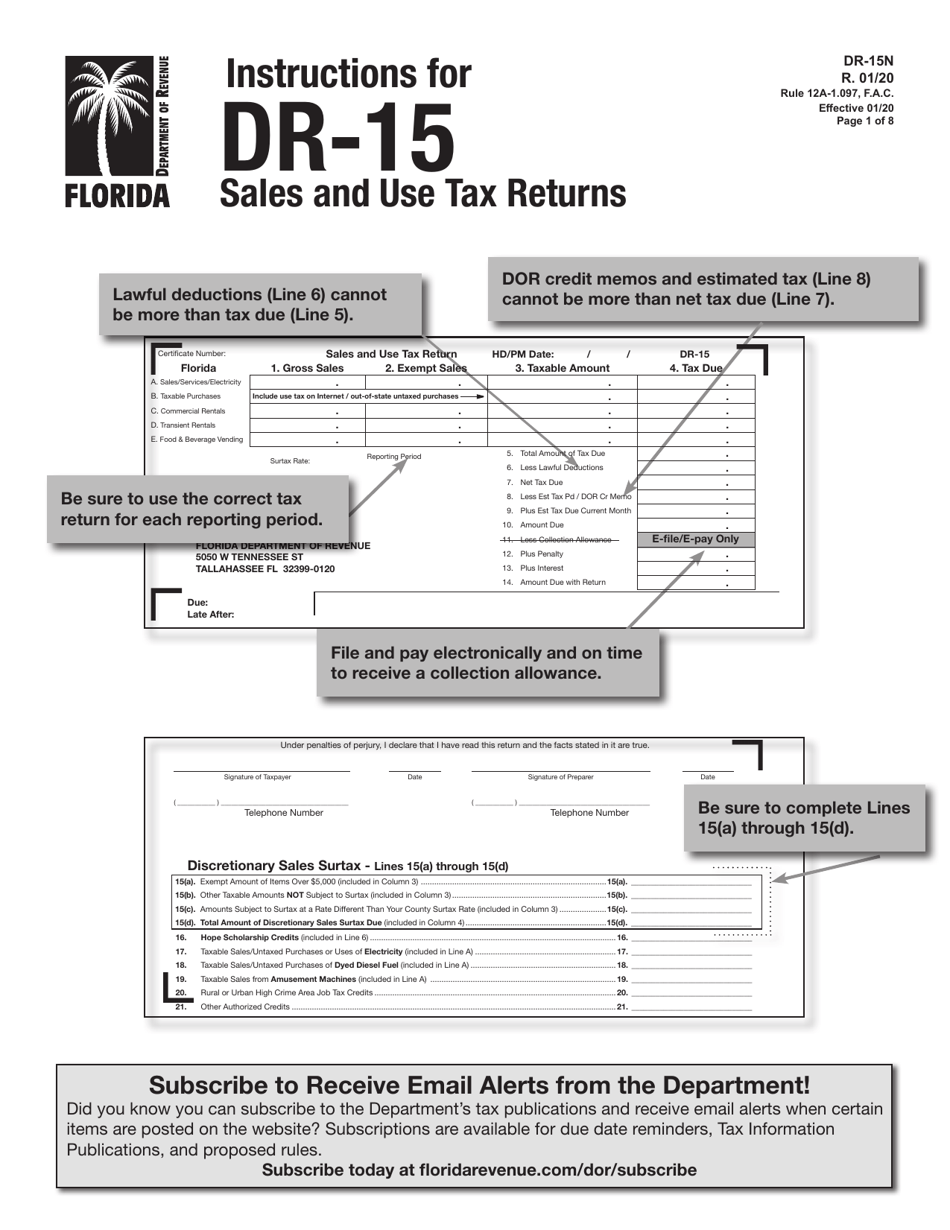

Download Instructions for Form DR15 Sales and Use Tax Return PDF

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay sales tax and discretionary sales surtax online at floridarevenue.com/taxes/registration (you. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales.

Gonzales Sales And Use Tax Report Form

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay sales tax and discretionary sales surtax online at floridarevenue.com/taxes/registration (you. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales.

Florida Appliance Sales Tax Exemption 2024 Linea Petunia

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay.

State Sales Tax State Sales Tax Exemption Florida

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay.

FL Sales & Use Tax & the Annual Reports / Ft Myers, Naples / MNMW

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You can register to collect, report and pay sales tax and discretionary sales surtax online at floridarevenue.com/taxes/registration (you. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales.

You Can Register To Collect, Report And Pay Sales Tax And Discretionary Sales Surtax Online At Floridarevenue.com/Taxes/Registration (You.

You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes. You must collect discretionary sales surtax along with the 6% state sales tax on taxable sales when delivery or use occurs in a county that imposes.