What Tax Form For Energy Credit

What Tax Form For Energy Credit - Information about form 5695, residential energy credits, including recent updates, related forms. Learn about tax credits for home energy efficiency upgrades and renewable energy systems. The inflation reduction act of 2022 amended the credits available for energy. Use form 5695 to figure and take your residential energy credits. Form 5695 is the irs document you submit to get a credit on your tax return for.

Learn about tax credits for home energy efficiency upgrades and renewable energy systems. Form 5695 is the irs document you submit to get a credit on your tax return for. Information about form 5695, residential energy credits, including recent updates, related forms. Use form 5695 to figure and take your residential energy credits. The inflation reduction act of 2022 amended the credits available for energy.

Use form 5695 to figure and take your residential energy credits. Learn about tax credits for home energy efficiency upgrades and renewable energy systems. Form 5695 is the irs document you submit to get a credit on your tax return for. The inflation reduction act of 2022 amended the credits available for energy. Information about form 5695, residential energy credits, including recent updates, related forms.

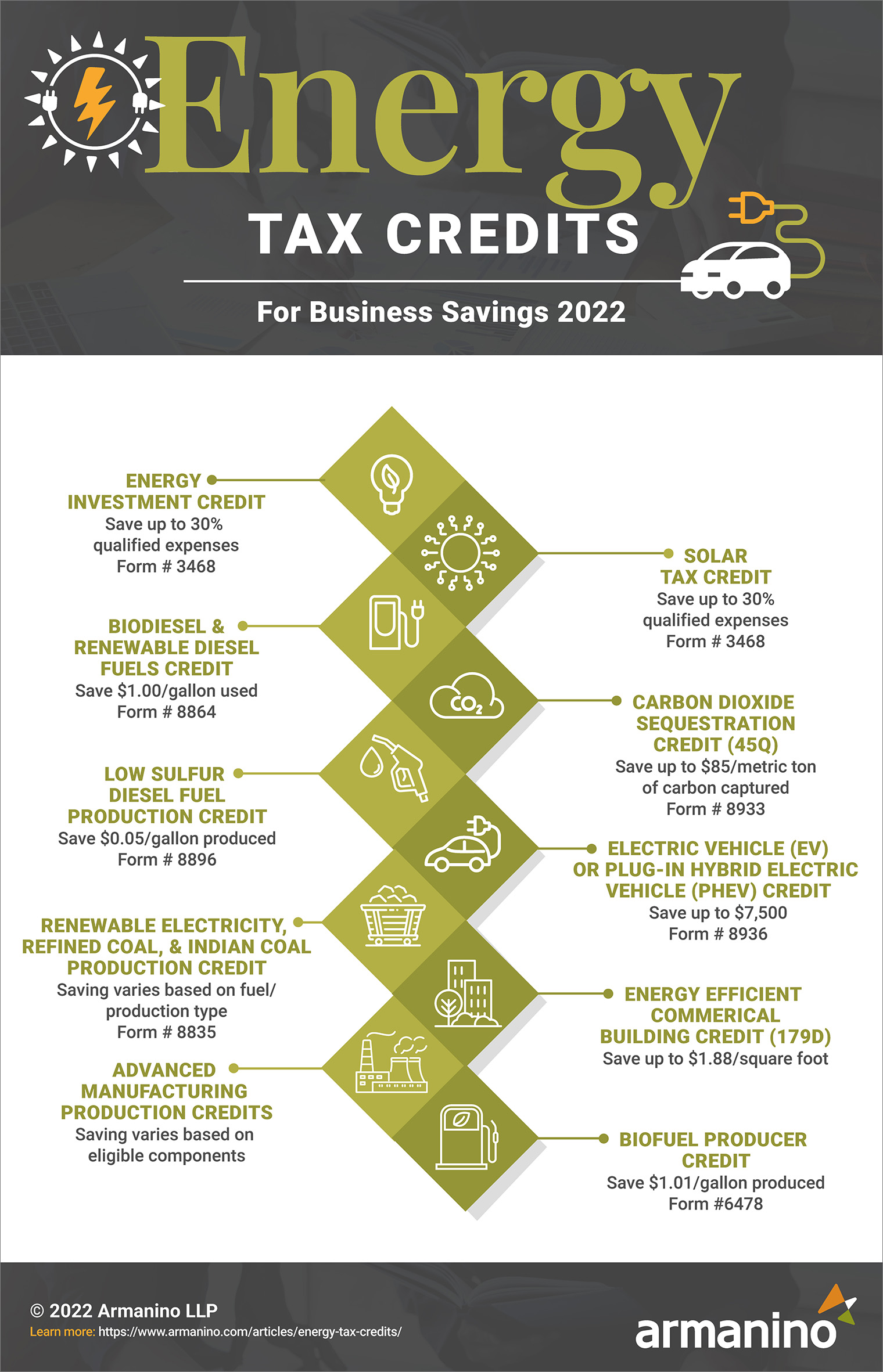

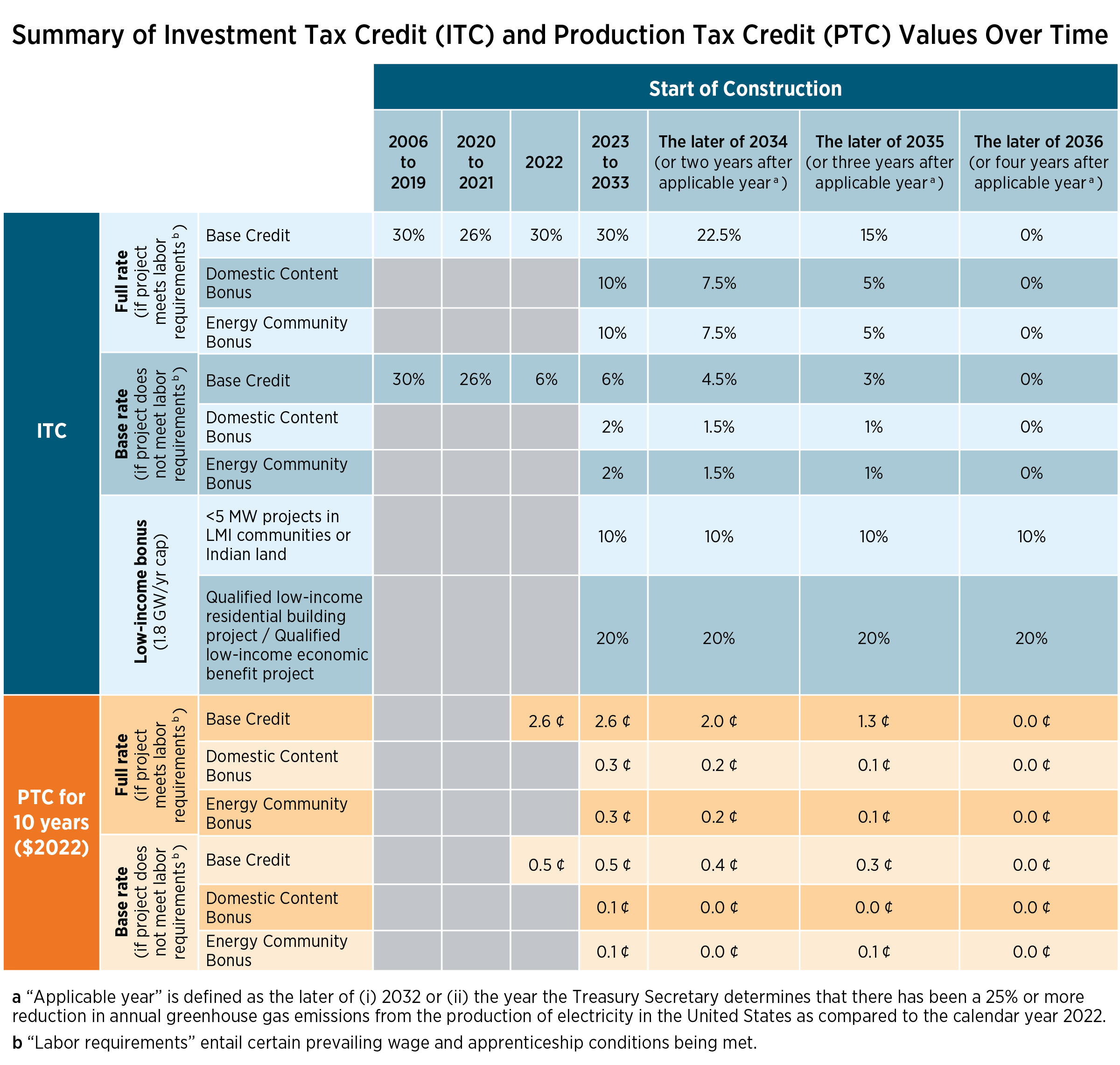

Energy Tax Credits Armanino

Learn about tax credits for home energy efficiency upgrades and renewable energy systems. Use form 5695 to figure and take your residential energy credits. The inflation reduction act of 2022 amended the credits available for energy. Information about form 5695, residential energy credits, including recent updates, related forms. Form 5695 is the irs document you submit to get a credit.

Energy Credit Tax Form Tips For Claiming Energy Tax Credits For 2024

Use form 5695 to figure and take your residential energy credits. Form 5695 is the irs document you submit to get a credit on your tax return for. Learn about tax credits for home energy efficiency upgrades and renewable energy systems. The inflation reduction act of 2022 amended the credits available for energy. Information about form 5695, residential energy credits,.

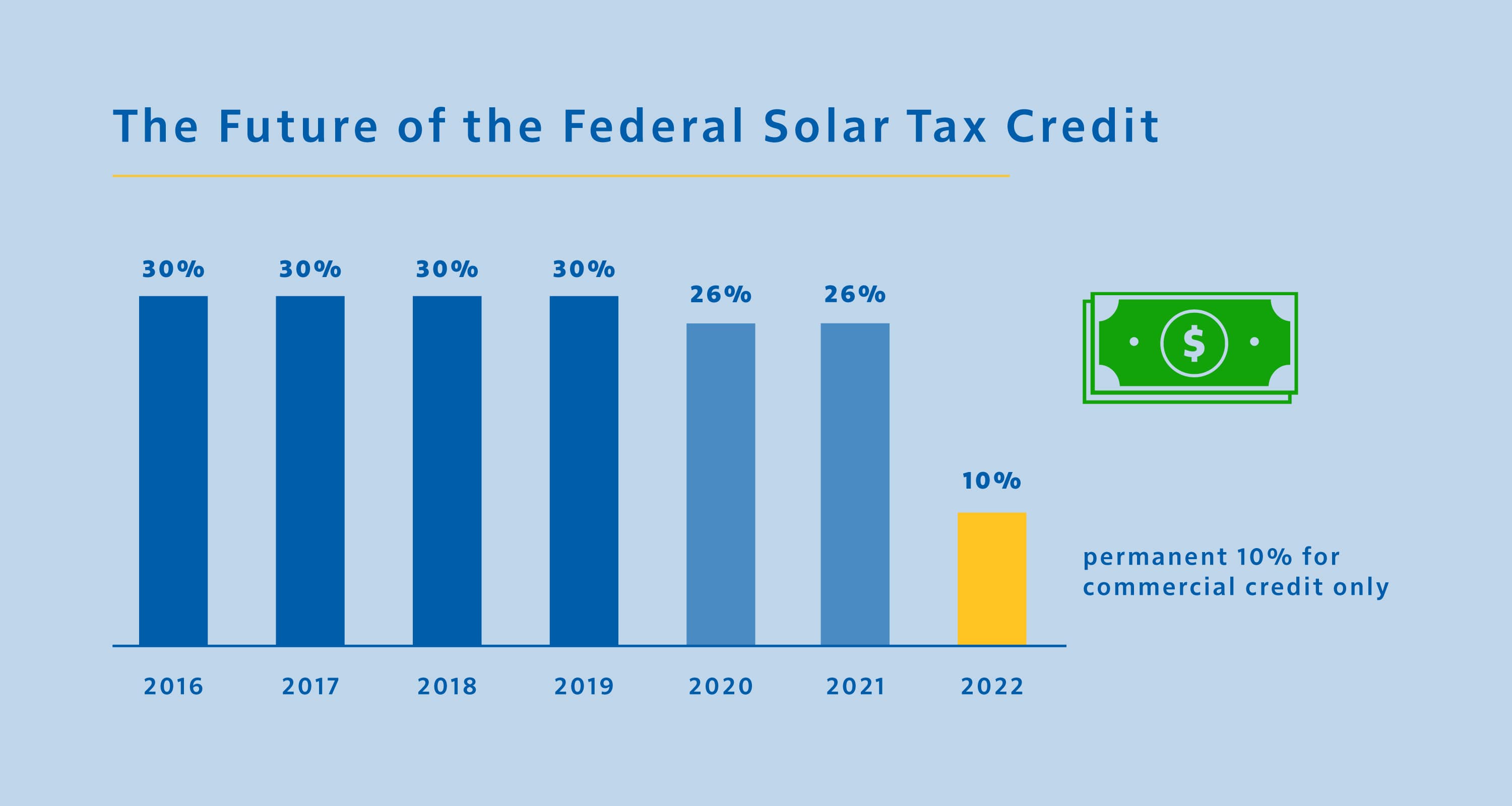

Federal Solar Tax Credit Ecohouse Solar, LLC

Learn about tax credits for home energy efficiency upgrades and renewable energy systems. The inflation reduction act of 2022 amended the credits available for energy. Information about form 5695, residential energy credits, including recent updates, related forms. Use form 5695 to figure and take your residential energy credits. Form 5695 is the irs document you submit to get a credit.

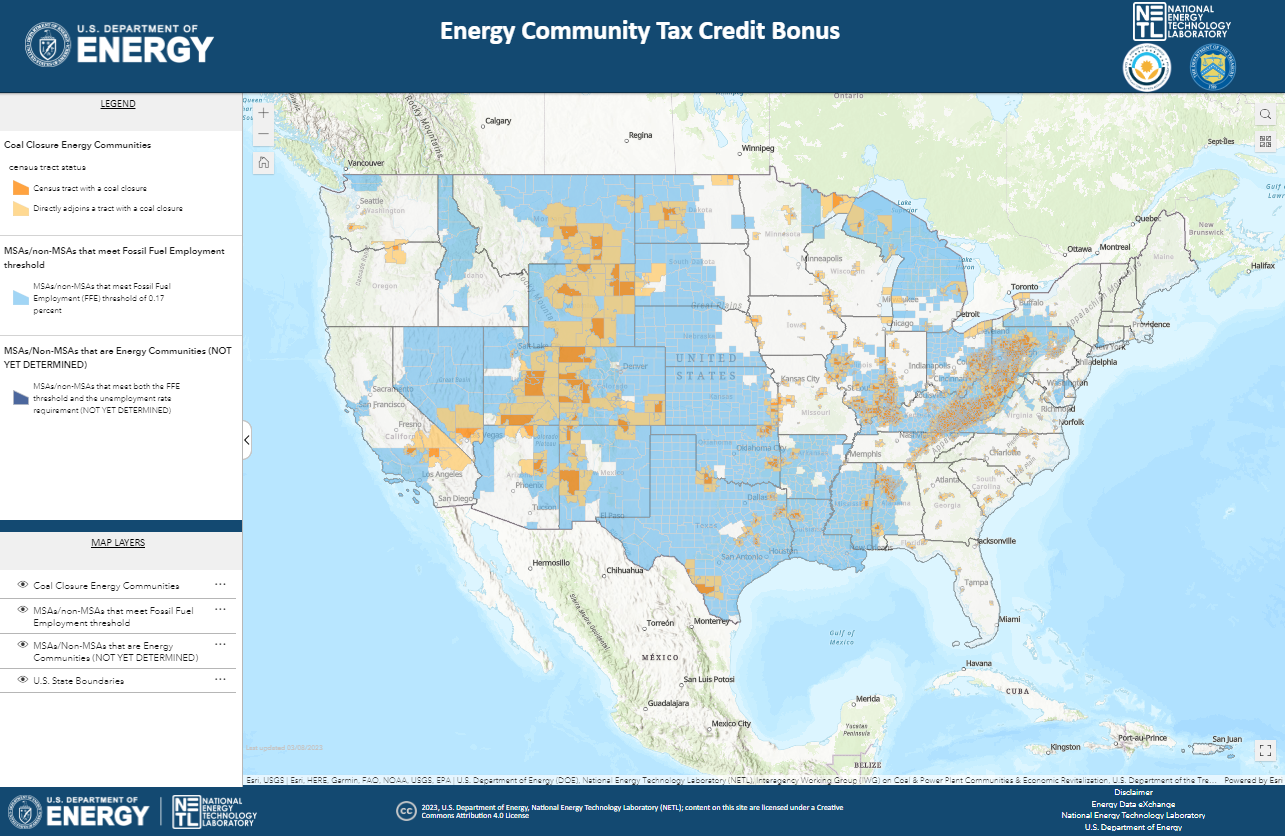

Energy Community Tax Credit Bonus Energy Communities

Form 5695 is the irs document you submit to get a credit on your tax return for. Learn about tax credits for home energy efficiency upgrades and renewable energy systems. Use form 5695 to figure and take your residential energy credits. Information about form 5695, residential energy credits, including recent updates, related forms. The inflation reduction act of 2022 amended.

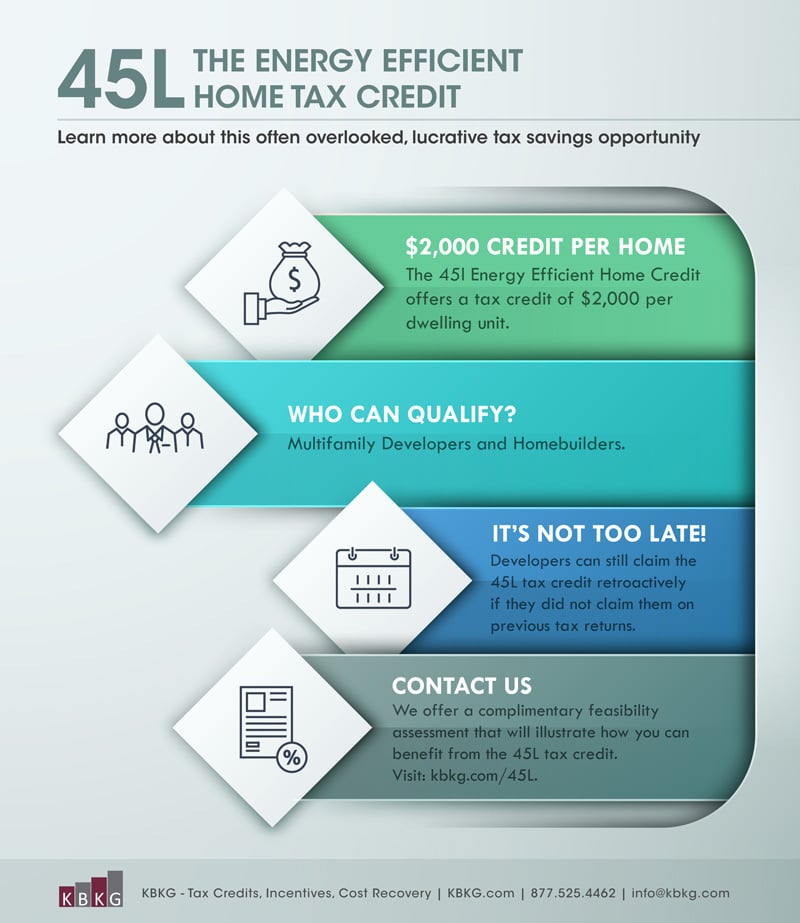

Is there a tax credit for energy efficient? Leia aqui What is the IRS

Form 5695 is the irs document you submit to get a credit on your tax return for. Learn about tax credits for home energy efficiency upgrades and renewable energy systems. Information about form 5695, residential energy credits, including recent updates, related forms. The inflation reduction act of 2022 amended the credits available for energy. Use form 5695 to figure and.

Federal Tax Credits Sunlight Solar Energy CO, OR, MA, CT

Use form 5695 to figure and take your residential energy credits. Learn about tax credits for home energy efficiency upgrades and renewable energy systems. Form 5695 is the irs document you submit to get a credit on your tax return for. Information about form 5695, residential energy credits, including recent updates, related forms. The inflation reduction act of 2022 amended.

Ohio Energy Tax Credits 2024 Addy Lizzie

Information about form 5695, residential energy credits, including recent updates, related forms. Form 5695 is the irs document you submit to get a credit on your tax return for. Learn about tax credits for home energy efficiency upgrades and renewable energy systems. The inflation reduction act of 2022 amended the credits available for energy. Use form 5695 to figure and.

Calculate the Energy Tax Credit for Residential Improvements

Information about form 5695, residential energy credits, including recent updates, related forms. Learn about tax credits for home energy efficiency upgrades and renewable energy systems. The inflation reduction act of 2022 amended the credits available for energy. Form 5695 is the irs document you submit to get a credit on your tax return for. Use form 5695 to figure and.

A Guide to Tax Credits for and Clean Energy and EnergyEfficient Home

Use form 5695 to figure and take your residential energy credits. Learn about tax credits for home energy efficiency upgrades and renewable energy systems. The inflation reduction act of 2022 amended the credits available for energy. Form 5695 is the irs document you submit to get a credit on your tax return for. Information about form 5695, residential energy credits,.

Energy Credits How To Qualify For A Federal Tax Credit When Installing

Information about form 5695, residential energy credits, including recent updates, related forms. Learn about tax credits for home energy efficiency upgrades and renewable energy systems. Use form 5695 to figure and take your residential energy credits. Form 5695 is the irs document you submit to get a credit on your tax return for. The inflation reduction act of 2022 amended.

Information About Form 5695, Residential Energy Credits, Including Recent Updates, Related Forms.

Use form 5695 to figure and take your residential energy credits. Form 5695 is the irs document you submit to get a credit on your tax return for. The inflation reduction act of 2022 amended the credits available for energy. Learn about tax credits for home energy efficiency upgrades and renewable energy systems.